Best car insurance with gap coverage is a crucial aspect of protecting your vehicle investment. Dive into this comprehensive guide to discover everything you need to know about securing the best coverage for your car.

From understanding the basics of gap coverage to tips for maximizing its benefits, this guide will equip you with the knowledge to make informed decisions when choosing the right insurance policy for your needs.

Understanding Gap Coverage in Car Insurance

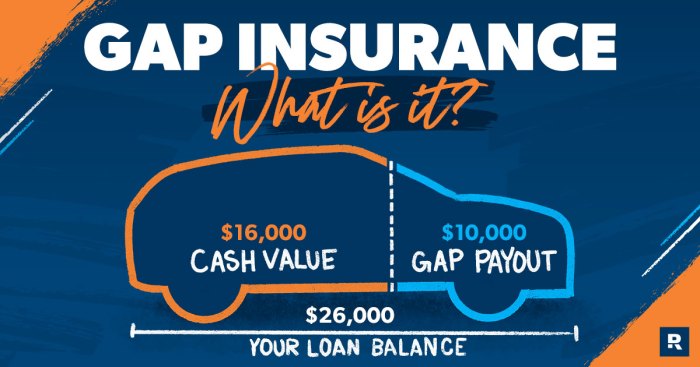

Gap coverage is an optional add-on to your car insurance policy that covers the “gap” between what you owe on your car loan or lease and the actual cash value of your vehicle in the event of a total loss due to theft or an accident. This coverage is particularly useful for new cars that depreciate quickly and can help you avoid financial strain in case of a significant loss.

Benefits of Having Gap Coverage

- Protects against financial loss: Gap coverage ensures that you are not left paying off a loan for a car you no longer have, preventing you from being upside down on your loan.

- Potential savings: By covering the remaining balance of your loan or lease, gap coverage can save you from having to make substantial out-of-pocket payments.

- Purchase peace of mind: Knowing that you are protected in case of a total loss can give you peace of mind and allow you to focus on other matters.

How Gap Coverage Works

Gap coverage typically kicks in when your car is declared a total loss and the actual cash value is less than what you owe on your loan or lease. In this situation, your primary auto insurance will pay out the actual cash value of the car, while the gap coverage will cover the remaining balance. It is important to note that gap coverage usually has limitations on the amount it will pay, so be sure to review your policy details carefully.

Factors to Consider When Choosing the Best Car Insurance with Gap Coverage

When selecting car insurance with gap coverage, there are several important factors to consider to ensure you get the best coverage for your needs.

Cost of Gap Coverage

The cost of gap coverage can vary between insurance providers. It is essential to compare quotes from different companies to find the most affordable option that still offers the coverage you need. Some factors that can affect the cost of gap coverage include your driving record, the make and model of your car, and your location.

Coverage Limits

Different insurance companies may offer varying coverage limits for gap insurance. It is crucial to understand the maximum amount the policy will pay out in the event of a total loss. Additionally, some policies may have restrictions on the age or mileage of the vehicle, so be sure to review these details carefully before making a decision.

Top Insurance Companies Offering the Best Car Insurance with Gap Coverage

When it comes to choosing the best car insurance with gap coverage, it’s essential to consider reputable insurance companies known for providing excellent service in this area. Let’s explore some of the top insurance companies that offer reliable gap coverage and the key features they provide.

Allstate

Allstate is a well-known insurance company that offers comprehensive gap coverage for vehicles. They provide coverage for the difference between what you owe on your car loan and the actual cash value of your vehicle in case of a total loss. Allstate’s gap coverage also includes coverage for your insurance deductible.

State Farm, Best car insurance with gap coverage

State Farm is another top insurance company that offers gap coverage as part of their auto insurance policies. Their gap coverage helps bridge the gap between what you owe on your car and its depreciated value in the event of a total loss. State Farm also provides coverage for up to 25% of the actual cash value of your vehicle.

GEICO

GEICO is known for its affordable insurance options, including gap coverage. GEICO’s gap coverage helps cover the difference between what you owe on your car loan and the actual cash value of your vehicle. They offer flexible payment options and competitive rates for gap coverage.

Progressive

Progressive is a popular choice for gap coverage due to its customizable options and competitive rates. Their gap coverage helps pay off your car loan in the event of a total loss, ensuring you are not left with a financial burden. Progressive also offers a variety of discounts to help you save on your insurance premiums.

Customer Reviews and Ratings

When it comes to customer reviews and ratings related to gap coverage services, it’s important to consider factors such as customer satisfaction, claims processing, and overall experience. Many customers have shared positive experiences with these top insurance companies, highlighting their efficient claims processing and helpful customer service when it comes to filing for gap coverage benefits.

Overall, choosing a reputable insurance company that offers the best car insurance with comprehensive gap coverage is crucial to ensuring financial protection in case of a total loss. Consider these top insurance companies and their key features when selecting the right gap coverage for your vehicle.

Tips for Maximizing Benefits from Car Insurance with Gap Coverage

When it comes to maximizing the benefits of car insurance with gap coverage, there are several strategies you can employ to ensure you are fully protected in case of an accident or theft. By understanding how to utilize this coverage effectively, you can avoid financial pitfalls and secure peace of mind.

One of the key ways to optimize the benefits of gap coverage is to choose the right deductible amount. A lower deductible may result in higher premiums, but it can also mean less out-of-pocket expenses in the event of a claim. On the other hand, a higher deductible can lower your premiums but may require you to pay more upfront if you need to make a claim.

Scenarios where Gap Coverage can be Particularly Useful

- Leased or financed vehicles: If you are leasing or financing a vehicle, gap coverage can protect you from owing more than the car’s actual cash value if it’s totaled.

- New car depreciation: In the case of a new car that rapidly depreciates in value, having gap coverage can cover the difference between what you owe and what the car is worth.

- High-interest loans: If you have a high-interest loan on your vehicle, gap coverage can prevent you from being stuck with a significant debt if the car is totaled.

Ensuring a Smooth Claims Process with Gap Coverage

- Keep detailed records: Make sure to keep all documentation related to your car purchase, lease agreement, and insurance policy in a safe place for easy access in case of a claim.

- Notify your insurer promptly: In the event of an accident or theft, notify your insurance company as soon as possible to start the claims process and provide all necessary information to expedite the settlement.

- Understand the coverage limits: Familiarize yourself with the terms and conditions of your gap coverage to know exactly what is covered and how much protection you have in different scenarios.

In conclusion, ensuring your vehicle is adequately protected with the best car insurance and gap coverage is essential for safeguarding your financial well-being. With the insights gained from this guide, you can navigate the insurance landscape with confidence and peace of mind.

When it comes to small cars, having liability insurance is crucial. This type of coverage protects you in case you’re at fault in an accident. It’s a small price to pay for peace of mind.

Leasing a vehicle? Make sure to consider getting gap insurance. This coverage fills the gap between what you owe on the lease and the actual value of the car in case of a total loss.

Wondering where you can find the cheapest states for liability insurance ? Look no further. These states offer affordable rates without compromising on coverage.