Gap insurance for leased vehicles provides essential protection for lessees, bridging the financial divide between what you owe on your lease and the actual value of your vehicle. As we delve into the nuances of this specialized insurance, you’ll uncover a wealth of information that can help you make informed decisions about safeguarding your investment.

Explore the key distinctions between gap insurance and standard auto insurance, understand the factors that influence the necessity of this coverage, and discover real-life scenarios where gap insurance has proven invaluable for leased vehicle owners.

What is Gap Insurance for Leased Vehicles?

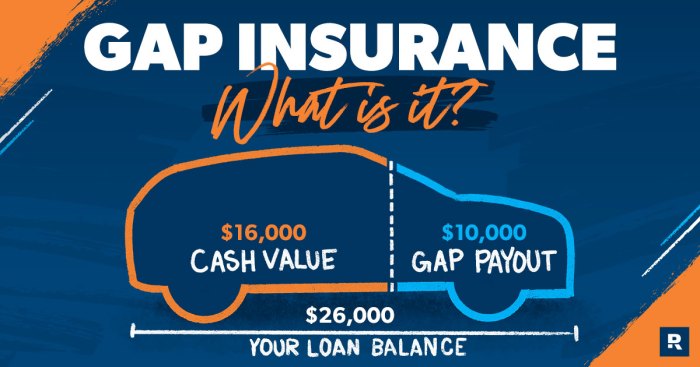

Gap insurance for leased vehicles is a type of coverage that protects a lessee in the event of a total loss of the vehicle where the insurance payout is less than the remaining amount owed on the lease. This “gap” in coverage can leave the lessee responsible for paying off the remaining balance on the lease, which can be a significant financial burden.

How does Gap Insurance Work?

Gap insurance works by covering the difference between the actual cash value of the leased vehicle at the time of loss and the remaining balance on the lease. For example, if a leased vehicle is involved in an accident and deemed a total loss, the insurance company will pay out the actual cash value of the vehicle. However, if this amount is less than what is owed on the lease, the gap insurance policy will cover the remaining balance, ensuring that the lessee is not left with a hefty bill to pay.

Importance for Leased Vehicles

Gap insurance is particularly important for leased vehicles because of how leases are structured. In a lease agreement, the lessee is responsible for the depreciation of the vehicle over the lease term. This means that the value of the vehicle may depreciate faster than the lease payments. In the event of a total loss, the insurance payout may not cover the remaining lease balance, leaving the lessee liable for the difference. Gap insurance provides peace of mind and financial protection in such scenarios, ensuring that the lessee is not burdened with additional costs.

Key Differences Between Gap Insurance and Regular Auto Insurance

Gap insurance and regular auto insurance serve different purposes in protecting leased vehicles. While regular auto insurance covers damages to the vehicle in accidents or incidents, gap insurance fills the “gap” between the actual cash value of the vehicle and the amount owed on the lease in case of a total loss.

Coverage Limitations, Gap insurance for leased vehicles

Regular auto insurance typically covers repairs or replacement costs up to the actual cash value of the vehicle at the time of the incident. This means that if the vehicle is totaled, the insurance will only pay out the current market value, which may be less than what is owed on the lease. On the other hand, gap insurance covers the difference between the amount paid by the regular insurance and the remaining balance on the lease, ensuring that the lessee is not left with a financial burden.

Scenarios

- Regular Auto Insurance: If a leased vehicle is involved in an accident and deemed a total loss, regular auto insurance will cover the actual cash value of the vehicle at the time of the incident. However, if the remaining lease balance is higher than the payout, the lessee will be responsible for the difference.

- Gap Insurance: In the same scenario, if the lessee has gap insurance, it will cover the remaining balance on the lease after the regular insurance payout, ensuring that the lessee is not financially burdened by the difference.

Factors to Consider When Deciding on Gap Insurance for Leased Vehicles

When deciding on whether to purchase gap insurance for a leased vehicle, there are several key factors that lessees should consider to make an informed decision. Understanding lease terms, vehicle depreciation, and potential financial risks can help determine the necessity of having gap insurance in place.

Lease Terms

Lease terms play a crucial role in determining the need for gap insurance. Shorter lease terms typically result in higher monthly payments but lower depreciation risk. On the other hand, longer lease terms may lead to significant depreciation of the vehicle’s value, increasing the likelihood of a gap between the lease balance and the actual cash value of the vehicle.

Vehicle Depreciation

Vehicle depreciation is a major factor in considering whether to purchase gap insurance. New vehicles depreciate rapidly, especially within the first few years. If the leased vehicle is involved in an accident or stolen, the insurance payout may not cover the remaining lease balance, leaving the lessee responsible for the gap amount.

Potential Financial Risks

Lessees should also assess their financial situation and ability to cover unexpected expenses in the event of a total loss of the leased vehicle. Without gap insurance, they may face financial strain having to pay off the remaining lease balance out of pocket.

- Review the lease agreement to understand the terms and conditions.

- Calculate the potential depreciation of the vehicle over the lease term.

- Assess your financial capability to cover a potential gap in case of a total loss.

- Compare the cost of gap insurance with the potential financial risks.

How Gap Insurance Benefits Leased Vehicle Owners: Gap Insurance For Leased Vehicles

Gap insurance offers several benefits to leased vehicle owners, providing financial protection in case of unexpected events such as accidents or theft. Let’s explore the advantages of having gap insurance for leased vehicles.

Financial Protection in Total Loss Situations

One of the key benefits of gap insurance is that it covers the “gap” between the actual cash value of the vehicle and the remaining balance on the lease in the event of a total loss. This means that if your leased vehicle is totaled or stolen, and the insurance payout is less than what you owe on the lease, the gap insurance will cover the difference.

Real-Life Examples of Gap Insurance Importance

Consider a scenario where a leased vehicle is involved in a severe accident, resulting in a total loss. Without gap insurance, the lessee would be responsible for paying the remaining balance on the lease, even if the insurance payout is insufficient. However, with gap insurance, the lessee is protected from bearing this financial burden, providing peace of mind during challenging times.

Peace of Mind for Lessees

Having gap insurance for a leased vehicle can provide peace of mind to lessees, knowing that they are financially safeguarded in case of unforeseen circumstances. This assurance allows lessees to enjoy their leased vehicle without worrying about potential financial liabilities in the event of a total loss.

In conclusion, Gap insurance for leased vehicles serves as a crucial safety net in the world of car leasing, offering peace of mind and financial security to lessees. By understanding the intricacies of this insurance, you can make sound decisions to protect your investment and drive with confidence.

When it comes to owning an SUV, it’s crucial to have liability insurance to protect yourself in case of accidents. This type of coverage can help cover the costs of damage or injuries caused by your vehicle to others.

Planning to rent a car? Don’t forget to consider getting collision insurance for added protection. This coverage can help pay for damages to the rental car in case of an accident.

Understanding bodily injury liability is essential when it comes to car insurance. This coverage can help pay for medical expenses or legal fees if you injure someone in an accident.