Gap insurance for financed cars ensures that you are not left with a financial gap in the unfortunate event of a total loss. This coverage is crucial for safeguarding your investment and providing peace of mind.

As we delve deeper into the world of gap insurance, you will uncover the intricacies of this valuable protection and why it is a wise choice for anyone with a financed vehicle.

What is Gap Insurance?: Gap Insurance For Financed Cars

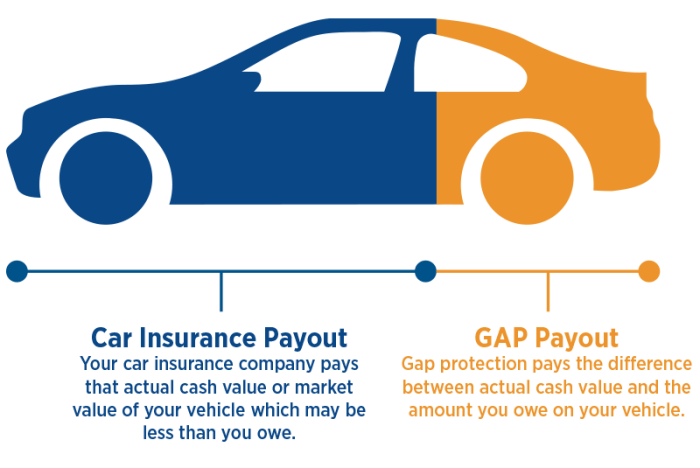

Gap insurance is a type of coverage that is designed to protect individuals who have financed their vehicles. It stands for “guaranteed asset protection” and helps bridge the gap between the amount owed on the car loan and the actual cash value of the vehicle in case of a total loss, such as theft or an accident.

Importance of Gap Insurance for Financed Cars

Gap insurance is essential for individuals with financed vehicles because it provides financial protection in situations where the car is deemed a total loss. Without gap insurance, individuals may find themselves responsible for paying the difference between what they owe on the loan and what the insurance company is willing to pay for the car.

- Protects Your Investment: Gap insurance ensures that you are not left with a significant financial burden if your financed car is totaled.

- Covers Depreciation: As cars depreciate in value over time, gap insurance covers the difference between the car’s value at the time of purchase and its current worth.

- Peace of Mind: Knowing that you are financially protected in the event of a total loss can provide peace of mind and alleviate stress.

Coverage Provided by Gap Insurance in Case of Total Loss

In the event of a total loss, gap insurance typically covers the difference between the amount owed on the car loan and the actual cash value of the vehicle. This can include:

- Remaining Loan Balance: Gap insurance pays off the remaining balance on the car loan after the primary insurance settlement.

- Deductible Coverage: It may also cover the deductible amount that you are required to pay as part of your primary insurance policy.

- Depreciation: Gap insurance accounts for the depreciation of the vehicle, ensuring that you are not left with a financial gap.

How Does Gap Insurance Work?

Gap insurance serves as a financial safety net for car owners who have financed their vehicles. In the event of a car being totaled or stolen, traditional auto insurance typically covers the actual cash value of the car at the time of the incident. However, this amount may not be enough to cover the remaining balance on the loan, leaving the owner responsible for the difference. This is where gap insurance comes in.

Scenario Examples

- If you owe $25,000 on your car loan but your car is only worth $20,000 at the time of the incident, your insurance will only cover the $20,000, leaving you with a $5,000 gap. Gap insurance would step in to cover this difference.

- In situations where a car is stolen and not recovered, traditional insurance may only provide the actual cash value of the vehicle. If the amount is not enough to pay off the loan, gap insurance would cover the remaining balance.

Actual Cash Value vs. Loan Amount

Gap insurance is necessary because the actual cash value of a car, which is determined by factors like depreciation and market value, may be lower than the amount owed on a loan. This discrepancy can leave car owners financially vulnerable in the event of a total loss. By bridging this gap, gap insurance ensures that car owners are not burdened with additional debt after an unfortunate incident.

Who Needs Gap Insurance?

Gap insurance is particularly beneficial for individuals who have financed a car through a loan or lease. This type of insurance can provide financial protection in case the car is declared a total loss and the insurance payout is insufficient to cover the remaining loan or lease balance.

Factors to Consider

- Loan or Lease Terms: Individuals with longer loan terms or leases are at a higher risk of owing more on the car than its actual value, making them prime candidates for gap insurance.

- Vehicle Depreciation: New cars tend to depreciate quickly in the first few years, leading to a potential gap between the car’s value and the loan amount.

- Down Payment Amount: A smaller down payment means a larger loan amount, increasing the likelihood of owing more than the car’s value.

- Driving Habits: Individuals who drive frequently or have long commutes are more prone to accidents, increasing the risk of a total loss situation.

Risks of Not Having Gap Insurance

- Financial Burden: Without gap insurance, individuals may be responsible for paying off a car loan or lease even if the car is no longer drivable.

- Negative Equity: In the event of a total loss, individuals might find themselves owing money on a car they no longer possess, leading to financial strain.

- Impact on Credit Score: Failing to pay off the remaining loan balance can result in a negative impact on credit scores, affecting future financial opportunities.

How to Obtain Gap Insurance?

When it comes to obtaining Gap Insurance for a financed vehicle, there are a few different options available to consumers. Let’s explore the process of purchasing gap insurance and where individuals can buy it, along with the typical cost associated with this type of coverage.

Purchasing Gap Insurance

- One option for obtaining gap insurance is through the dealership where you are purchasing or leasing your vehicle. Dealerships often offer gap insurance as an add-on to your financing package.

- Another option is to purchase gap insurance through an insurance company. Many insurance providers offer gap insurance as an additional coverage option that can be added to your existing auto insurance policy.

Cost of Gap Insurance

- The cost of gap insurance can vary depending on the provider, the value of your vehicle, and other factors. On average, gap insurance can cost anywhere from $20 to $40 per year when added to your auto insurance policy.

- Dealership-offered gap insurance may be more expensive compared to purchasing it from an insurance company, so it’s essential to compare prices and coverage options before making a decision.

Options for Obtaining Gap Insurance, Gap insurance for financed cars

- Some insurance companies may allow you to purchase gap insurance directly online or over the phone, making it a convenient option for those who prefer to handle their insurance needs independently.

- If you choose to purchase gap insurance through a dealership, make sure to carefully review the terms and conditions of the policy to understand what is covered and any limitations that may apply.

In conclusion, Gap insurance for financed cars serves as a safety net, bridging the divide between the actual cash value of your car and the outstanding loan amount. By understanding the importance of this coverage, you can make informed decisions to protect your financial well-being.

When planning a road trip, it’s essential to have comprehensive insurance to protect yourself and your vehicle from unexpected situations. This type of coverage can give you peace of mind knowing that you’re financially protected in case of accidents or damages along the way.

For those who lease cars, having comprehensive insurance is crucial to avoid any financial burdens in case of accidents or theft. It’s important to understand the terms of your insurance policy to ensure that you’re fully covered while driving a leased vehicle.

New drivers should consider getting liability insurance to protect themselves from potential legal and financial liabilities. This type of insurance can cover damages or injuries caused by the driver to others on the road, providing a safety net for new and inexperienced drivers.