Rental car coverage options encompass a variety of choices that can impact your rental experience. From understanding different coverage types to navigating coverage limits, it’s essential to make informed decisions. Let’s delve into the intricacies of rental car coverage options to help you choose wisely.

Types of Rental Car Coverage Options

When renting a car, it is important to understand the different types of coverage options available to protect yourself in case of any unforeseen incidents. Let’s explore the various rental car coverage options and their benefits.

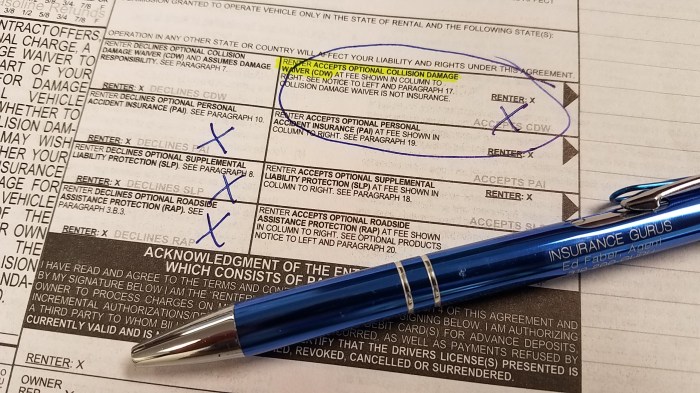

Collision Damage Waiver (CDW), Rental car coverage options

- Collision Damage Waiver, also known as Loss Damage Waiver (LDW), is a type of coverage that relieves you of financial responsibility if your rental car is damaged or stolen.

- CDW typically does not cover damage to other vehicles or property, but it can be a valuable option to avoid high repair costs.

- This coverage is often recommended for those who want peace of mind and do not want to worry about paying for damages out of pocket.

Supplemental Liability Insurance (SLI)

- Supplemental Liability Insurance provides additional liability coverage beyond the basic limits of the rental car company’s insurance.

- SLI can protect you in case you are at fault in an accident and the damages exceed the standard liability coverage.

- This coverage is recommended for those who want extra protection against potential lawsuits or high liability claims.

Personal Accident Insurance

- Personal Accident Insurance provides coverage for medical expenses and accidental death benefits for you and your passengers in the event of an accident.

- This coverage can help cover hospital bills, ambulance fees, and other medical expenses resulting from a car accident.

- Personal Accident Insurance is recommended for those who want to ensure they are financially protected in case of injuries while driving a rental car.

Understanding Coverage Limits: Rental Car Coverage Options

When it comes to rental car insurance, coverage limits refer to the maximum amount an insurance policy will pay for a covered loss or damage to a rental vehicle. These limits can vary depending on the type of coverage selected and the insurance provider.

Common Coverage Limits for Rental Car Insurance

- Bodily Injury Liability: This coverage typically has limits that range from $25,000 to $100,000 per person and $50,000 to $300,000 per accident. These limits determine how much the insurance company will pay for injuries to others in an accident where you are at fault.

- Property Damage Liability: The coverage limit for property damage liability usually ranges from $10,000 to $50,000. This limit represents the maximum amount the insurance company will pay for damages to another person’s property.

- Comprehensive and Collision Coverage: These coverages often come with a deductible, which is the amount you must pay out of pocket before the insurance kicks in. Typical deductibles range from $250 to $1,000.

Impact of Coverage Limits on Cost

Coverage limits can significantly impact the cost of rental car coverage options. Higher coverage limits mean more protection, but they also come with higher premiums. Conversely, opting for lower coverage limits can reduce your premium costs but may leave you exposed to greater financial risk in the event of an accident. It’s essential to strike a balance between adequate coverage and affordability when selecting rental car insurance options.

Rental Car Coverage vs. Personal Auto Insurance

When it comes to rental car coverage versus personal auto insurance, there are important distinctions to be aware of. Let’s delve into the key differences and considerations between the two.

Coverage Differences

Personal auto insurance typically provides coverage for your own vehicle in the event of an accident, theft, or damage. However, this coverage may not extend to rental cars. Rental car coverage, on the other hand, specifically provides insurance for rental vehicles, offering protection in case of accidents, theft, or other incidents while using the rental car.

Coverage Extent

While some personal auto insurance policies may offer limited coverage for rental cars, it is essential to review your policy carefully to understand the extent of coverage. In many cases, personal auto insurance may not provide the same level of protection as a dedicated rental car coverage plan.

Advantages and Disadvantages

Advantages of relying on personal auto insurance for rental cars include potential cost savings if your policy already includes some coverage for rentals. However, disadvantages may arise if your personal auto insurance coverage is insufficient for rental car incidents, leaving you vulnerable to out-of-pocket expenses. Opting for a standalone rental car coverage plan can provide comprehensive protection and peace of mind when using rental vehicles.

Factors to Consider When Choosing Rental Car Coverage

When selecting rental car coverage options, there are several key factors that individuals should consider to ensure they have the right protection in place. Factors such as the type of trip, destination, and personal insurance coverage can all influence the decision-making process. To help guide individuals through this process, here is a checklist of factors to consider when evaluating rental car coverage options.

Type of Trip

- Consider the purpose of the trip – whether it’s for business, leisure, or personal reasons.

- Determine the duration of the trip – short-term rentals may have different coverage needs compared to long-term rentals.

- Assess the mileage you plan to drive – some policies have restrictions on mileage.

Destination

- Research the driving conditions and road safety of your destination.

- Check if the rental car coverage extends to international travel if you are going abroad.

- Understand any specific insurance requirements or regulations in the destination country or state.

Personal Insurance Coverage

- Review your existing personal auto insurance policy to see if rental cars are already covered.

- Determine the coverage limits and exclusions of your personal policy to identify any gaps in coverage.

- Consider whether additional coverage is needed based on your personal insurance policy.

In conclusion, navigating the realm of rental car coverage options can seem daunting, but armed with the right knowledge, you can make informed choices that suit your needs. By considering factors like trip type, destination, and personal insurance coverage, you can ensure a smooth and stress-free rental experience.

When it comes to protecting your vehicle, having collision coverage car insurance is essential. This type of policy helps cover the cost of repairs or replacement if your car is damaged in a collision. By investing in collision coverage car insurance , you can drive with peace of mind knowing you’re protected.

For comprehensive protection, consider bundling comprehensive and collision insurance together. These bundles offer coverage for a wide range of incidents, from collisions to theft and vandalism. By opting for comprehensive and collision insurance bundles , you can ensure your vehicle is fully protected in any situation.

Understanding how liability insurance works is crucial for all drivers. This type of coverage helps pay for damages and injuries caused to others in an accident where you’re at fault. Learn more about how liability insurance works to make informed decisions about your coverage needs.