How gap insurance works sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Gap insurance is a crucial aspect of financial planning when it comes to protecting your vehicle. Understanding how it works can help you make informed decisions in uncertain situations.

Overview of Gap Insurance

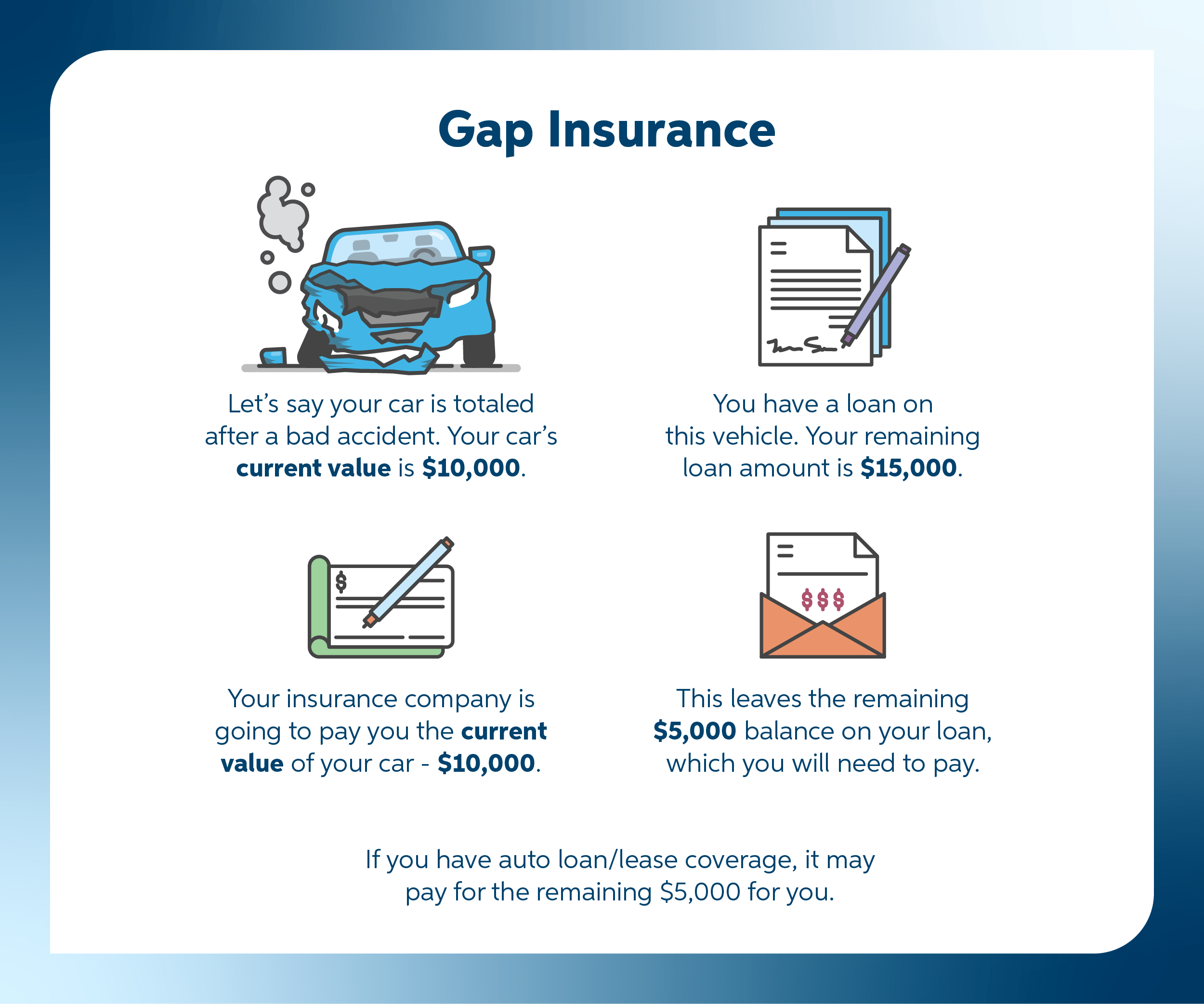

Gap insurance, also known as guaranteed asset protection insurance, is a type of coverage that helps protect you financially in case your car is totaled or stolen when you still owe more on your auto loan than the car’s current market value. This can happen if you have a new car that depreciates quickly or if you made a small down payment on the vehicle.

Benefits of Gap Insurance

- Gap insurance covers the “gap” between what you owe on your car loan and the actual cash value of your vehicle.

- It can prevent you from having to pay out of pocket for the remaining balance on your loan if your car is deemed a total loss.

- It provides peace of mind knowing that you won’t be left with a financial burden if something happens to your car.

Difference Between Gap Insurance and Regular Car Insurance

Regular car insurance typically covers damages to your vehicle, liability for injuries or damage to others, and other related costs. However, it does not cover the difference between what you owe on your car loan and the car’s actual value in case of a total loss. Gap insurance specifically addresses this financial gap, providing additional protection beyond what regular car insurance offers.

Coverage Details

Gap insurance typically covers the following expenses in the event of a total loss of your vehicle:

- The difference between the actual cash value (ACV) of your vehicle and the remaining balance on your auto loan or lease.

- Deductibles on your primary auto insurance policy.

- Additional costs like sales tax, registration fees, and other expenses associated with purchasing a new vehicle.

Scenarios where gap insurance coverage applies

Gap insurance coverage applies in situations such as:

- Your car is stolen and not recovered.

- Your car is totaled in an accident and the insurance payout is not enough to cover your remaining loan or lease amount.

Limitations or exclusions of gap insurance coverage

While gap insurance provides valuable coverage, it may have limitations or exclusions, such as:

- Coverage may not apply if you are behind on your loan payments.

- Some policies may have a limit on the amount they will pay out.

- Gap insurance typically does not cover extended warranties, credit life insurance, or other add-ons to your loan.

How Gap Insurance Works

Gap insurance functions as a valuable coverage option in the event of a total loss of your vehicle. It helps bridge the gap between what you owe on your auto loan and the actual cash value of the vehicle at the time of the loss, which can be significant if your car is totaled.

Claims Process with Gap Insurance

When you experience a total loss of your vehicle, you would typically start by filing a claim with your primary auto insurance provider. Once they determine the vehicle is a total loss and the payout amount, you can then file a claim with your gap insurance provider.

- After filing a claim with your gap insurance provider, they will assess the remaining balance on your auto loan after the primary insurance payout.

- Gap insurance will then cover the difference between the primary insurance payout and the remaining loan balance, up to the policy limit.

- It’s important to provide all necessary documentation and information to the gap insurance provider to expedite the claims process.

Payout Calculation with Gap Insurance

The payout amount with gap insurance is typically calculated based on the actual cash value of the vehicle at the time of the loss and the remaining balance on your auto loan.

- The actual cash value is determined by factors such as the age, condition, and mileage of the vehicle.

- The remaining balance on the auto loan includes the principal amount, interest, and any applicable fees.

- The payout from gap insurance will cover the difference between these two amounts, ensuring you are not left with a significant financial burden after a total loss.

Purchasing Gap Insurance: How Gap Insurance Works

When it comes to purchasing gap insurance, there are a few key things to consider to ensure you get the right coverage at the best price. Here we will discuss where and how to buy gap insurance, compare costs from different providers, and the factors to keep in mind when choosing a policy.

Where and How to Buy Gap Insurance

- Gap insurance can typically be purchased from your car dealership when buying or leasing a new vehicle.

- You can also buy gap insurance from insurance companies, banks, credit unions, or online providers.

- It’s essential to shop around and compare quotes from different providers to find the best deal.

Comparing the Cost of Gap Insurance

- The cost of gap insurance can vary depending on the provider, your vehicle’s make and model, and your location.

- Consider getting quotes from multiple insurers to compare prices and coverage options.

- Some car insurance companies may offer gap insurance as an add-on to your existing policy, so check with your current provider for availability.

Factors to Consider when Choosing a Gap Insurance Policy, How gap insurance works

- Make sure you understand what is covered by the gap insurance policy, including any limitations or exclusions.

- Consider the term of coverage and whether it aligns with your loan or lease agreement.

- Check the claim process and how quickly claims are processed in the event of a total loss.

- Look for any additional benefits or features offered by the gap insurance policy, such as deductible reimbursement or coverage for aftermarket additions.

In conclusion, grasping the intricacies of how gap insurance works can be the key to safeguarding your investment. Stay informed, stay protected.

When it comes to protecting yourself in the event of an accident, having Personal injury protection (PIP) insurance is crucial. This type of coverage can help pay for medical expenses and lost wages, regardless of who is at fault.

After a collision, navigating the collision insurance claim process can be overwhelming. From filing a claim to getting your vehicle repaired, understanding the steps involved is essential to ensure a smooth process.

For owners of custom vehicles, having comprehensive insurance for custom vehicles is a must. This type of coverage can protect your unique vehicle against a wide range of risks, providing peace of mind on the road.