Gap insurance for hybrid vehicles provides crucial financial protection for owners of these eco-friendly cars. In this comprehensive guide, we’ll delve into the intricacies of this type of insurance and how it can safeguard your investment.

From the factors to consider when deciding on coverage to the benefits it offers and how to obtain it, this article will equip you with the knowledge needed to make informed decisions about protecting your hybrid vehicle.

What is Gap Insurance for Hybrid Vehicles?

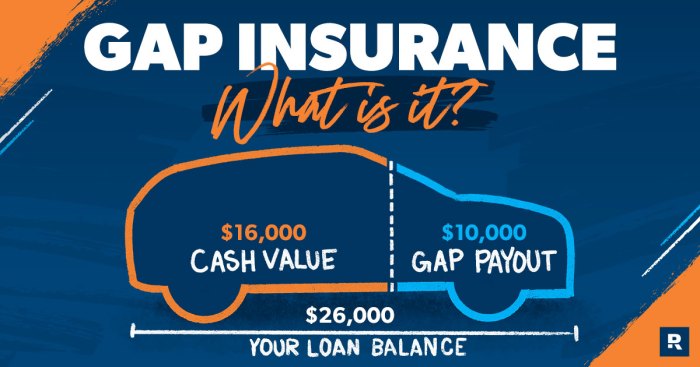

Gap insurance for hybrid vehicles is a type of insurance coverage that helps bridge the gap between what you owe on your car loan and the actual cash value of your hybrid vehicle if it is deemed a total loss due to an accident or theft. This type of insurance is particularly important for hybrid car owners as the value of hybrid vehicles can depreciate faster than traditional gasoline-powered vehicles.

How Gap Insurance Works for Hybrid Vehicles

Gap insurance works by covering the “gap” between what you owe on your car loan and the actual cash value of your hybrid vehicle. In the event of a total loss, such as a severe accident or theft, where your car is deemed a write-off, your standard insurance policy will only pay out the current market value of the vehicle. This amount may not be enough to cover the remaining balance of your car loan, especially for hybrid vehicles that tend to depreciate quickly.

- For example, let’s say you owe $25,000 on your hybrid vehicle, but its actual cash value at the time of the total loss is only $20,000. Without gap insurance, you would be responsible for paying the $5,000 difference out of pocket.

- With gap insurance, the policy would cover the $5,000 gap, ensuring that you are not left with a financial burden after the loss of your hybrid vehicle.

Factors to Consider When Deciding on Gap Insurance for Hybrid Vehicles

When considering whether to purchase gap insurance for your hybrid vehicle, there are several important factors to keep in mind. Let’s explore some key considerations below.

Depreciation Rate of Hybrid Vehicles

Hybrid vehicles typically experience a higher rate of depreciation compared to traditional gasoline-powered vehicles. This is due to the rapidly evolving technology in the hybrid market, which can impact the value of your vehicle over time. It’s essential to consider this depreciation rate when evaluating the potential need for gap insurance.

Comparison of Gap between Actual Cash Value and Loan Balance

One critical factor in determining the need for gap insurance is the potential gap between your hybrid vehicle’s actual cash value and the remaining loan balance. In the event of a total loss, such as theft or a severe accident, the insurance payout may not cover the full amount you owe on your loan. This shortfall could leave you financially responsible for the remaining balance without gap insurance.

Typical Coverage Limits and Costs

Gap insurance for hybrid vehicles typically comes with coverage limits and costs that vary depending on the insurance provider. It’s essential to review the specific terms and conditions of the gap insurance policy to understand the coverage limits and associated costs. Consider factors such as the deductible, coverage duration, and premium costs when deciding on the right gap insurance for your hybrid vehicle.

Benefits of Gap Insurance for Hybrid Vehicles

Gap insurance for hybrid vehicles offers several key benefits, providing financial protection for owners in case of theft or total loss situations. Let’s delve into how gap insurance can safeguard hybrid car owners from potential financial loss and unexpected circumstances.

Protection from Financial Loss

Gap insurance plays a crucial role in protecting hybrid car owners from financial loss by covering the “gap” between the actual cash value of the vehicle and the remaining balance on the loan or lease. In the event of a total loss due to an accident or theft, traditional insurance policies may only cover the actual cash value of the vehicle, which could be lower than the outstanding balance. This is where gap insurance steps in to bridge that financial disparity, preventing owners from being left with a hefty amount to pay off.

- For example, consider a scenario where a hybrid vehicle is involved in a severe accident, resulting in a total loss. The insurance company determines the actual cash value of the car to be $25,000, but the remaining loan balance is $30,000. Without gap insurance, the owner would be responsible for the $5,000 difference. However, with gap insurance in place, this financial burden is alleviated.

Coverage in Case of Theft or Total Loss, Gap insurance for hybrid vehicles

Gap insurance provides coverage specifically for instances of theft or total loss, ensuring that hybrid car owners are not left with a significant financial burden in such unfortunate events. By covering the gap between the car’s actual cash value and the remaining loan or lease balance, gap insurance offers peace of mind and financial security to owners facing challenging circumstances.

- In the case of theft, where the vehicle is not recovered, traditional insurance policies may only compensate based on the car’s value at the time of theft. However, with gap insurance, the owner is protected from having to pay off the remaining loan amount despite no longer possessing the vehicle.

Prevention of Financial Strain in Unexpected Situations

Gap insurance serves as a valuable safety net for hybrid car owners, preventing them from experiencing financial strain in unexpected situations such as accidents, theft, or total loss. By covering the shortfall between the car’s value and the loan balance, gap insurance ensures that owners are not burdened with additional expenses during already stressful times.

- For instance, if a hybrid vehicle is declared a total loss due to unforeseen circumstances like severe weather damage, having gap insurance can ease the financial impact on the owner. Instead of facing a significant financial setback, the gap insurance coverage steps in to mitigate the financial burden, allowing the owner to focus on moving forward without added financial worries.

How to Obtain Gap Insurance for Hybrid Vehicles

When it comes to obtaining gap insurance for hybrid vehicles, there are specific steps that hybrid car owners need to follow to ensure they are adequately covered in case of a total loss.

Where to Purchase Gap Insurance for Hybrid Vehicles

- Check with your current auto insurance provider: Start by contacting your current auto insurance company to see if they offer gap insurance for hybrid vehicles as an add-on to your existing policy.

- Specialized insurance companies: Look for insurance companies that specialize in offering coverage for hybrid vehicles, as they may have better options tailored to your specific needs.

- Online insurance providers: Consider exploring online insurance providers that offer gap insurance for hybrid vehicles, as they may have competitive rates and convenient online processes.

Tips for Choosing the Right Coverage and Provider

- Evaluate coverage options: Compare the coverage options offered by different insurance providers to ensure you select a policy that meets your needs and provides adequate protection in the event of a total loss.

- Consider the cost: While cost is an important factor, it is essential to balance affordability with the level of coverage provided to ensure you are adequately protected without overpaying for gap insurance.

- Read reviews and ratings: Take the time to research and read reviews from other hybrid car owners about their experiences with different insurance providers to gauge their reputation and customer service quality.

- Review the terms and conditions: Carefully review the terms and conditions of the gap insurance policy to understand the coverage limits, exclusions, and claim procedures to avoid any surprises in the event of a total loss.

In conclusion, Gap insurance for hybrid vehicles bridges the gap between your car’s value and what you owe, ensuring you’re not left with a financial burden in case of theft or total loss. With the right coverage in place, you can drive with peace of mind knowing your investment is safeguarded.

When it comes to preparing for natural disasters, having comprehensive coverage for natural disasters is crucial. This type of insurance can provide financial protection in the event of unpredictable incidents such as hurricanes, earthquakes, or floods.

For those who are unfamiliar with insurance terminology, understanding comprehensive coverage can be overwhelming. It essentially offers a wide range of protection for various risks, making it a valuable investment for peace of mind.

Looking to save on insurance costs? Consider moving to one of the cheapest states for liability insurance. By comparing rates and coverage options, you can find affordable solutions to meet your insurance needs.