Gap insurance for electric vehicles provides essential financial protection for EV owners, bridging the gap between the car’s value and what is owed on it. As we delve into the world of EV insurance, let’s explore why this coverage is crucial in today’s market.

What is Gap Insurance for Electric Vehicles?

Gap insurance for electric vehicles is a type of insurance coverage that helps bridge the gap between what you owe on your EV loan or lease and the actual cash value of the vehicle in case of a total loss. This type of insurance is particularly important for electric vehicle owners due to the higher upfront costs associated with EVs compared to traditional gas-powered vehicles.

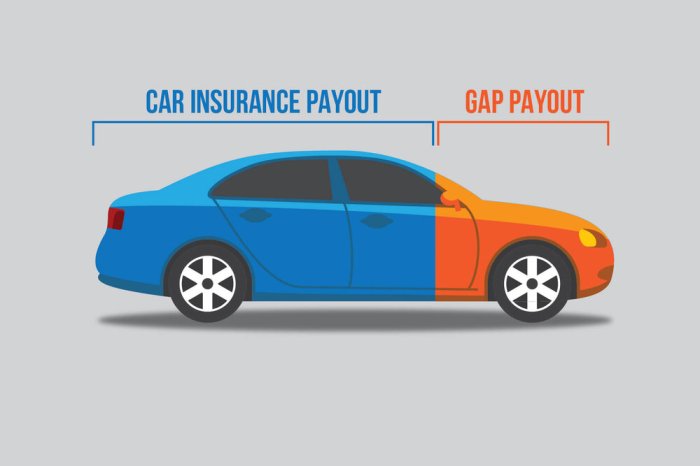

Gap insurance for electric vehicles differs from regular auto insurance in that it specifically covers the depreciation that occurs as soon as you drive your EV off the lot. While traditional auto insurance typically covers the actual cash value of the vehicle at the time of loss, gap insurance can help cover the remaining balance on your loan or lease after your primary insurance has paid out.

Benefits of Gap Insurance for EV Owners

- Protects against depreciation: Electric vehicles tend to depreciate faster than gas-powered vehicles, making gap insurance essential to cover the difference between the vehicle’s value and what you owe.

- Coverage for total loss: In the event of a total loss due to an accident or theft, gap insurance can help ensure you are not left with a substantial financial burden.

- Peace of mind: Knowing that you have gap insurance can provide peace of mind and financial protection in case of unforeseen circumstances.

Understanding the Need for Gap Insurance

Gap insurance for electric vehicles becomes crucial due to the rapid depreciation rates associated with these cars. Electric vehicles tend to lose their value quicker than traditional gasoline cars, making them more susceptible to a financial gap in case of an accident or theft.

Depreciation Rates of Electric Vehicles

One of the key factors that make gap insurance essential for electric vehicles is their high depreciation rates. EVs can lose up to 50% of their value within the first three years of ownership, leaving owners at risk of owing more on their loan or lease than the car is worth.

How Gap Insurance Helps Cover the “Gap”

Gap insurance is designed to bridge the difference between the actual cash value of the vehicle (what the insurance company would pay in case of a total loss) and the amount that the owner still owes on the car loan or lease. This coverage ensures that the owner does not have to bear the financial burden of paying off a vehicle they no longer possess.

Scenarios Where Gap Insurance Protects EV Owners

- Scenario 1: Total Loss Accident – In the event of a severe accident where the electric vehicle is deemed a total loss, the insurance payout may not be enough to cover the remaining balance on the loan. Gap insurance steps in to cover this difference, saving the owner from having to pay out of pocket.

- Scenario 2: Theft – If the electric vehicle is stolen and not recovered, the insurance payout may fall short of what is owed. Once again, gap insurance ensures that the owner is not left with a financial burden.

- Scenario 3: Early Trade-In – If an EV owner decides to trade in their vehicle before paying off the loan or lease, gap insurance can help cover the difference between the trade-in value and the remaining balance, preventing negative equity.

Factors Influencing Gap Insurance Costs

Gap insurance costs for electric vehicles can vary based on several factors that influence the overall pricing. Let’s explore the key elements that impact the cost of insuring the gap for electric vehicles.

Type of Electric Vehicle

The type of electric vehicle you own can significantly affect the cost of gap insurance. Factors such as the model, make, and year of the EV can impact the insurance rates. Generally, more expensive electric vehicles may have higher insurance costs due to the increased value that needs to be covered by the policy.

Loan Terms

The terms of your loan agreement can also play a role in determining the cost of gap insurance for your electric vehicle. Longer loan terms may result in higher insurance premiums as there is a longer period during which the vehicle depreciates in value. Additionally, the down payment amount and interest rate on the loan can influence the gap insurance costs.

Driving Habits

Your driving habits, including the average mileage driven annually and the way you use your electric vehicle, can impact the gap insurance rates. Vehicles driven more frequently or over longer distances may be at a higher risk of depreciation, affecting the insurance costs. Safe driving habits and proper maintenance of the EV can help mitigate some of these factors.

Comparison of Electric Vehicle Models, Gap insurance for electric vehicles

When comparing the cost of gap insurance for different electric vehicle models, it’s important to consider factors such as the initial purchase price, depreciation rate, and market value. Higher-end electric vehicle models may have higher insurance costs compared to more affordable options. Additionally, factors like safety ratings and repair costs can also influence the insurance rates for different EV models.

How to Obtain Gap Insurance for Electric Vehicles

When it comes to obtaining gap insurance for electric vehicles, there are a few key steps to keep in mind. This type of insurance can provide valuable protection in the event that your EV is totaled or stolen, covering the difference between what you owe on your car loan and the actual cash value of the vehicle. Here’s how you can secure gap insurance for your electric vehicle.

Research Different Providers

- Start by researching different insurance providers that offer gap insurance for electric vehicles. Look for companies that specialize in EV insurance or have experience in this area.

- Compare quotes from multiple providers to ensure you’re getting the best coverage at a competitive price.

- Consider working with an insurance broker who can help you navigate the process and find the right policy for your needs.

Check with Your Auto Lender

- Contact your auto lender to see if they offer gap insurance for electric vehicles. Some lenders may include this coverage as part of your financing agreement.

- If gap insurance is not provided by your lender, they may be able to recommend reputable insurance companies that offer this type of coverage.

- Keep in mind that purchasing gap insurance through your lender may be convenient, but it’s important to compare prices and coverage options with other providers.

Consider Third-Party Insurers

- In addition to checking with your auto lender, explore gap insurance options from third-party insurers. These companies specialize in gap coverage and may offer more competitive rates than your lender.

- Research the reputation and financial stability of third-party insurers before making a decision. Look for customer reviews and ratings to gauge the quality of their services.

- Review the terms and conditions of the gap insurance policy carefully to ensure it meets your needs and provides adequate coverage for your electric vehicle.

In conclusion, gap insurance for electric vehicles offers peace of mind and financial security for EV owners, ensuring they are adequately protected in the event of a total loss. Stay informed and make the right choice to safeguard your investment.

When it comes to protecting your vehicle from acts of vandalism, having comprehensive coverage is essential. With comprehensive coverage for vandalism , you can have peace of mind knowing that your car is fully protected against damages caused by intentional harm. This type of insurance goes beyond just basic coverage, providing financial support for a wide range of scenarios.

For those looking to enhance their insurance coverage, adding comprehensive insurance add-ons can be a smart choice. These additional options can provide extra protection for your vehicle, such as coverage for rental car expenses, roadside assistance, and more. With comprehensive insurance add-ons , you can customize your policy to suit your specific needs and budget.

Older cars may require special attention when it comes to insurance coverage. With comprehensive insurance for older cars , you can ensure that your vehicle is protected against a variety of risks, including theft, vandalism, and natural disasters. This type of coverage is designed to address the unique needs of older vehicles, providing peace of mind for owners.