Kicking off with Cheap liability car insurance, this opening paragraph is designed to captivate and engage the readers, setting the tone ahrefs author style that unfolds with each word.

Liability car insurance is a crucial aspect of vehicle ownership, providing financial protection in case of accidents. Understanding the factors that influence costs and tips for finding affordable coverage can help drivers make informed decisions.

Overview of Liability Car Insurance

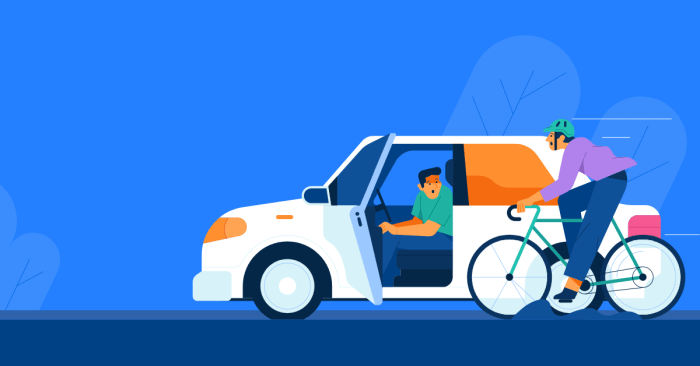

Liability car insurance is a type of coverage that helps protect drivers financially in case they are found responsible for causing an accident. It is a mandatory requirement in most states in the United States.

Tesla Compact, the upcoming subcompact EV, is set to revolutionize the Electric Vehicle Market. With its innovative design and cutting-edge technology, Tesla is once again pushing the boundaries of what is possible in the world of electric vehicles. The compact size of this EV makes it perfect for urban environments, while still delivering impressive performance and range. Learn more about the Tesla Compact here.

Importance of Liability Car Insurance

- Provides financial protection: Liability car insurance helps cover the costs of property damage and medical expenses for other parties involved in an accident.

- Legal requirement: In many states, liability car insurance is mandatory to legally operate a vehicle on the road.

Types of Coverage in Liability Car Insurance

- Property Damage Liability: Covers the costs of repairing or replacing the property of others that you damage in an accident.

- Bodily Injury Liability: Helps cover the medical expenses of other individuals injured in an accident where you are at fault.

Factors Affecting Cost: Cheap Liability Car Insurance

When it comes to determining the cost of liability car insurance, several factors come into play. Understanding these factors can help drivers make informed decisions and potentially save money on their premiums.

Age and Driving Record

Age and driving record are two significant factors that can impact insurance rates. Younger drivers, especially teenagers, typically face higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents. On the other hand, older drivers may also face higher rates as they may have slower reaction times and more health-related issues that could affect their driving abilities. Additionally, drivers with a history of accidents or traffic violations are considered higher risk and may see an increase in their insurance costs.

- Younger drivers and teenagers tend to have higher insurance rates due to their lack of experience.

- Older drivers may also face higher premiums due to age-related factors affecting their driving abilities.

- Drivers with a history of accidents or traffic violations are considered higher risk and may see an increase in insurance costs.

Type of Vehicle and Coverage Limits

The type of vehicle you drive and the coverage limits you choose can also impact the cost of liability car insurance. Sports cars and luxury vehicles are typically more expensive to insure due to their higher repair costs and increased likelihood of theft. On the other hand, choosing higher coverage limits can provide more protection but also result in higher premiums.

- Sports cars and luxury vehicles are more expensive to insure due to higher repair costs and theft risks.

- Choosing higher coverage limits can lead to increased protection but also higher premiums.

Tips for Finding Cheap Liability Car Insurance

Finding affordable liability car insurance is crucial for saving money while ensuring adequate coverage. Here are some tips to help you secure cheap liability car insurance:

Compare Multiple Quotes

One of the most effective ways to find cheap liability car insurance is by comparing quotes from different insurers. Each insurance company has its own pricing structure, so getting multiple quotes allows you to choose the most cost-effective option.

Opt for Higher Deductibles

Choosing a higher deductible can lower your insurance premium significantly. While this means you’ll have to pay more out of pocket in the event of a claim, it can help reduce your overall insurance costs.

Take Advantage of Discounts

Many insurance companies offer discounts for various reasons, such as having a clean driving record, bundling multiple policies, or completing a defensive driving course. Be sure to inquire about any available discounts to lower your premiums.

Maintain a Good Credit Score

Your credit score can impact your insurance rates. By maintaining a good credit score, you may be eligible for lower premiums on your liability car insurance.

Drive Less, Cheap liability car insurance

Some insurers offer discounts for policyholders who drive fewer miles. If you can reduce your annual mileage, you may qualify for a lower rate on your liability car insurance.

Understanding Coverage Limits

When it comes to liability car insurance, coverage limits play a crucial role in determining the extent of protection you have in case of an accident. These limits represent the maximum amount your insurance company will pay for damages or injuries resulting from an accident where you are at fault.

Significance of Choosing Appropriate Coverage Limits

- Choosing appropriate coverage limits is essential to ensure you are adequately protected financially in the event of a serious accident. If your coverage limits are too low, you may end up having to pay out-of-pocket for damages that exceed your limits.

- On the other hand, opting for high coverage limits may increase your premium, but it can provide you with peace of mind knowing that you are well-protected in case of a costly accident.

- It is important to assess your financial situation and the value of your assets to determine the right coverage limits for your needs.

Examples of How Coverage Limits Impact Insurance Costs

- For instance, if you choose the minimum coverage required by your state, which is often referred to as 25/50/25 (meaning $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage), your premium is likely to be lower compared to opting for higher coverage limits.

- Conversely, if you decide to increase your coverage limits to 100/300/100, your premium will increase due to the higher level of protection provided by these limits.

- Insurance companies consider coverage limits as one of the key factors when calculating premiums, so it’s essential to strike a balance between adequate coverage and affordability.

In conclusion, Cheap liability car insurance is not just about saving money, but also about ensuring adequate protection. By comparing quotes, understanding coverage limits, and exploring discounts, drivers can secure the right policy for their needs.

Model Y Performance is unleashing the ultimate Tesla powerhouse, offering unmatched speed and agility. This high-performance electric SUV is redefining what it means to drive a sustainable vehicle without compromising on power. With lightning-fast acceleration and top-of-the-line features, the Model Y Performance is a game-changer in the electric vehicle industry. Discover more about this powerhouse here.

Exploring Model Y Long Range reveals the ultimate electric SUV that combines luxury, range, and sustainability. With an impressive battery range and spacious interior, the Model Y Long Range is perfect for long road trips and daily commutes. Tesla has once again set the bar high for electric SUVs, offering a premium driving experience without emissions. Find out more about the ultimate electric SUV here.