Affordable gap insurance for cars opens up a world of financial security and peace of mind for car owners. Let’s delve into the details of how you can find the best deals and protect your investment.

Understanding Gap Insurance

Gap insurance is a type of coverage that can be crucial for car owners, especially those who have financed or leased their vehicles. It is designed to protect you in case your car is deemed a total loss and the amount you owe on your loan or lease is more than the car’s current market value.

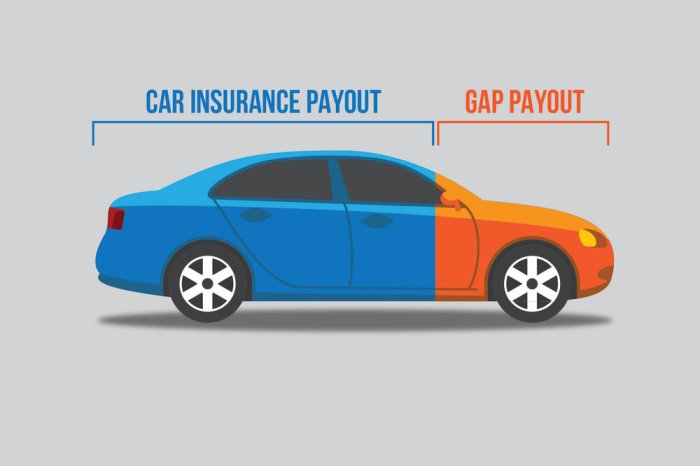

Gap insurance covers the “gap” between what your car is worth and what you still owe on it. For example, if your car is totaled in an accident and your insurance company determines that the car’s value is $20,000, but you still owe $25,000 on your loan, gap insurance would cover the $5,000 difference.

Benefits of Gap Insurance

- Protects you from financial loss in case of a total loss accident

- Ensures you are not left with a large loan balance after your insurance payout

- Provides peace of mind knowing you are fully covered

Factors Affecting Gap Insurance Cost

When it comes to the cost of gap insurance, several factors come into play that can influence the price you pay for this coverage. Understanding these factors is crucial in determining how much you will need to budget for your gap insurance policy.

Type of Vehicle, Affordable gap insurance for cars

The type of vehicle you own can significantly impact the cost of gap insurance. Generally, more expensive vehicles will have higher gap insurance premiums due to the larger gap between the car’s actual cash value and the amount owed on the loan.

Loan Terms and Coverage Limits

The terms of your loan and the coverage limits you choose for your gap insurance policy can also affect the cost. Longer loan terms and higher coverage limits will typically result in higher premiums, as the potential gap between the car’s value and the loan balance is greater.

Driver’s Age and Driving History

Your age and driving history can play a role in determining the cost of your gap insurance. Younger drivers and those with a history of accidents or traffic violations may face higher premiums, as they are considered higher risk by insurance companies.

Finding Affordable Gap Insurance

Finding affordable gap insurance for cars can be crucial to protect your investment without breaking the bank. Here are some tips to help you find the best deal and potentially save money on your premiums.

Comparing Different Insurance Providers

When looking for affordable gap insurance, it’s essential to compare different insurance providers and their offerings. Take the time to research and gather quotes from multiple companies to see which one provides the most competitive rates for the coverage you need.

- Check with your current auto insurance provider to see if they offer gap insurance as an add-on to your existing policy. Bundling your coverage with one provider can sometimes lead to discounts.

- Look into specialized insurers that focus on gap insurance specifically. They may offer more competitive rates compared to larger, more general insurance companies.

- Consider online insurance marketplaces that allow you to compare quotes from multiple providers at once. This can help you easily identify the most affordable options available to you.

Negotiating Lower Premiums or Discounts

Negotiating lower premiums or discounts on gap insurance is another strategy to make this coverage more affordable.

- Ask about available discounts, such as multi-policy discounts or discounts for safe driving records. Some insurance companies offer savings to policyholders who demonstrate responsible driving habits.

- Consider increasing your deductible to lower your premiums. Just make sure you can comfortably afford the deductible amount in case you need to make a claim in the future.

- Be willing to negotiate with insurance providers. If you can show that you are a loyal customer or that you have done your research and received lower quotes elsewhere, some providers may be willing to match or beat those rates to earn your business.

Benefits of Affordable Gap Insurance: Affordable Gap Insurance For Cars

Affordable gap insurance offers car owners several key benefits that can provide financial protection and peace of mind in case of unforeseen circumstances.

Financial Protection in Case of Theft or Total Loss

- Gap insurance covers the “gap” between the actual cash value of a car and the amount still owed on a loan or lease.

- In the event of theft or total loss due to an accident, traditional insurance may not cover the full amount owed, leaving the car owner responsible for the remaining balance.

- Having affordable gap insurance ensures that car owners are not left with a significant financial burden in such situations.

Peace of Mind and Financial Security

- Knowing that affordable gap insurance is in place can provide peace of mind to car owners, especially those with newer or more expensive vehicles.

- In case of unexpected events like accidents, theft, or natural disasters, gap insurance can help alleviate financial stress by covering the remaining balance on a loan or lease.

- By offering an added layer of financial security, affordable gap insurance allows car owners to focus on getting back on the road without worrying about the financial implications of a total loss.

In conclusion, affordable gap insurance for cars is a crucial investment that offers protection and peace of mind in uncertain times. Take the necessary steps to secure your vehicle and finances today.

When it comes to protecting your vehicle from unexpected natural disasters, such as flooding, having comprehensive car insurance for flood damage is essential. This type of coverage can provide financial protection in case your car gets damaged due to floodwaters. It’s important to review your policy details carefully to ensure you have the right coverage in place.

Choosing the right insurance provider is crucial, especially when it comes to liability coverage. Researching and comparing the options available can help you find the best-rated liability insurance providers that offer comprehensive coverage at competitive rates. Make sure to read reviews and ratings to make an informed decision.

For owners of older cars, investing in comprehensive insurance for older cars can provide peace of mind. This type of insurance can cover potential damages and repairs for your aging vehicle, ensuring you’re protected on the road. Consider the value of your car and your driving habits when choosing the right coverage.